What Expenses Can You Deduct and How to Calculate Them from Your Vacation Rental Income?

17/04/2025

17/04/2025Owning a vacation rental property in paradise, like Tenerife or another of the Canary Islands, can be both a rewarding investment and a source of steady income. But to truly benefit from your short-term rental, it’s essential to understand the financial side—especially which expenses you can legally deduct and how to calculate them.

At Pambnb, we help property owners simplify every part of their rental business, from guest check-ins to financial reporting. One of the most important advantages we offer is assistance with expense tracking and annual tax statements, which can make a real difference when it comes to your net earnings.

In this post, we’ll walk you through:

- What types of vacation rental expenses are tax-deductible,

- How to properly calculate these expenses, with examples,

- The specific implications for owners in the Canary Islands (Spain),

- And how Pambnb can help you maximize your return while staying compliant.

Why Knowing Your Deductions Matters

Many property owners underestimate how much they can deduct from their taxable income. That means they end up paying more tax than they need to.

By keeping track of deductible expenses and reporting them correctly, you can:

- Lower your annual tax liability,

- Get a clearer picture of your actual profit,

- Stay compliant with Spanish tax authorities, especially when submitting Modelo 210 (for non-resident property owners),

- And make smarter investment decisions for the future.

I did a research on the expenses, clear up the current canvas and only put the part regarding expenses

Types of Deductible Expenses for Vacation Rentals

Fully Deductible Expenses Directly Related to Rental Activity

These are costs exclusively incurred due to the rental operation. If the property generates income only during guest stays, these expenses are 100% deductible without any need for prorating. They include:

- Cleaning and Laundry Services

Costs for cleaning the property and laundering linens after each guest stay. - Platform Commissions and Agency Fees

Commissions paid to Airbnb, Booking.com, or agencies for each confirmed reservation.

Example: Paying a 15% fee to Airbnb on each booking.

- Marketing and Advertising

Spending on professional photos, enhanced listings, or promotional material to attract bookings. - Guest Welcome Supplies and Amenities

Items consumed exclusively by guests, such as bottled water, toiletries, coffee capsules, or cleaning products. - Property Management Software and Tools

Costs of tools and systems used to manage the rental, such as PMS subscriptions or digital check-in systems. - Professional Services

Expenses for tax advisors, accountants, lawyers, or admin help linked to the rental activity.

Example: Hiring a gestoría to file quarterly IGIC returns and Model 130.

- Management Services

Fees for property management (like Pambnb!), accountants, and legal consultations are all deductible. - IGIC Paid to the Canary Islands Tax Agency

If the owner is not under REPEP, the total IGIC paid each quarter to the Agencia TributariaCanaria is deductible as an operating expense. This is the amount declared in Model 425. If the owner is part of REPEP, this amount is typically zero, as no IGIC is charged or paid.

All these expenses must be documented with invoices in the owner’s name and linked directly to the property to ensure deductibility.

Proportionally Deductible Expenses Based on Personal vs. Guest Use

If the property is not rented out year-round (e.g., 292 days per year, that means 292 / 365 = 80% occupancy), certain general or ongoing expenses must be prorated based on actual rental use. These include:

- Property Tax (IBI)

Annual municipal tax on property ownership.

Example: Annual IBI is €500. With 80% occupancy, €400 is deductible. - Municipal Taxes and Local Fees

Such as garbage collection, sewer fees, or water treatment charges. - Community Fees

Charges by homeowners' associations or building management. - Home Insurance Premiums

Insurance for fire, theft, liability, and general property protection. - Utilities

Electricity, water, internet, gas, and telephone bills. - Mortgage Interest

Interest (not principal) paid on loans for property purchase or renovation.

Example: Annual interest of €2,000 → €1,600 deductible. - Depreciation (Amortization) of Property and Furnishings

Wear-and-tear allowance on property structure and contents.

Example:

- Property: Value €150,000 (excluding land) → 3% = €4,500 x 80% = €3,600 deductible.

- Furnishings: Value €20,000 → 10% = €2,000 x 80% = €1,600 deductible.

- Maintenance and Repairs

Upkeep needed to maintain the rental in habitable condition.

Example: €1,000 spent repainting the walls → €800 deductible.

Important: Major improvements or renovations that increase the property’s value (e.g., adding a room or remodeling a kitchen) are not deductible directly but must be amortized gradually. Also, if the property is used personally during the year, those periods are considered non-deductible.

By properly categorizing and calculating these expenses in line with IRPF regulations (Arts. 23 and 27 of Law 35/2006 and corresponding DGT consultations), property owners can legally reduce their tax base while staying compliant with Spanish tax authorities.

Different Types of Owners and Their Tax Declarations

Vacation rental income in Spain is taxed differently depending on the tax residency status of the property owner. Below is a breakdown of the three main categories of owners and their corresponding tax obligations, including applicable forms, tax rates, and deduction rights.

Spanish Fiscal Residents – Declaring Income Through IRPF

If you are a tax resident in Spain, your vacation rental income must be declared as part of your annual IRPF (Impuestosobre la Renta de las Personas Físicas) return. This includes:

- Declaring all income from the rental activity as part of your global income.

- Submitting your tax return during the annual campaign (usually between April and June for the previous fiscal year).

- Deducting all eligible expenses related to the rental activity, including both fully deductible and proportionally deductible expenses, as outlined previously.

Non-Residents in the EU/EEA – Declaring with Model 210 and Deducting Expenses

Non-residents who are tax residents in the European Union or European Economic Area (and who are not considered tax residents in Spain) are subject to non-resident income tax via Model 210. They benefit from more favorable tax treatment:

- Tax rate: 19% on net income (income after allowable expenses).

- Filing frequency: Typically, annually by January 20 for income earned the previous year. Alternatively, the owner may choose to file quarterly, within 20 days after each calendar quarter (e.g., by April 20 for Q1).

- Deductible expenses: EU/EEA residents may deduct the same types of expenses as Spanish residents, provided they can justify the expense with valid documentation and invoices.

To apply these deductions, the non-resident must certify their tax residence in an EU/EEA country (usually with a residency certificate issued by their local tax authority).

Non-Residents Outside the EU/EEA – Declaring with Model 210 Without Deductions

Owners who are tax residents outside the EU or EEA face stricter rules under Spanish tax law:

- Tax rate: 24% on gross rental income.

- Filing frequency: Typically, annually by January 20 for income earned the previous year. Alternatively, the owner may choose to file quarterly, within 20 days after each calendar quarter (e.g., by April 20 for Q1).

- No expenses or taxes (not even IGIC) can be deducted from the gross income.

This means that these owners are taxed on the total rental revenue without the ability to offset any operational costs. For example, if an owner receives €10,000 in rental income for a quarter, they must pay €2,400 in taxes regardless of how much they spent on cleaning, commissions, or maintenance.

Understanding your fiscal status and the associated tax rules is crucial to staying compliant and optimizing your returns.

How to Accurately Calculate Deductible Expenses for Your Vacation Rental

To understand how taxes work in practice, let’s look at a simple real-life example. This will help clarify how deductions and tax liabilities vary depending on your fiscal residence.

Meet Carlos: Vacation Rental Owner in Costa Adeje

Carlos owns a two-bedroom apartment in Costa Adeje, Tenerife. In the past year:

- The property was rented for 292 days (out of 365), meaning an occupancy rate of 80%.

- He earned €25,000 in gross rental income.

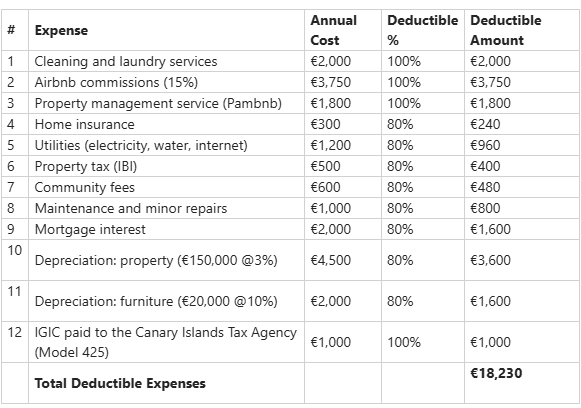

Carlos has incurred the following annual expenses:

Net Income: €25,000 - €18,230 = €6,770

Let’s see how much tax Carlos pays depending on where he resides:

Carlos is a Spanish Fiscal Resident

- Taxable Base (IRPF): €6,770

- Applicable Tax Rate: Progressive (starts at 19% and can go up to 47%)

- Estimated Tax (assuming lowest bracket for illustration):

- 19% × €6,770 = €1,286.30

Carlos must declare this income in his annual IRPF between April and June. If this is an economic activity, he may also have filed Model 130 quarterly.

Carlos is a Non-Resident in the EU/EEA (e.g., Germany)

- Form: Model 210

- Taxable Base: €6,770 (expenses are deductible)

- Flat Tax Rate: 19%

- Tax Due: 19% × €6,770 = €1,286.30

Carlos would typically file Model 210 annually in January, or optionally quarterly. He must provide proof of EU residency to apply the 19% rate and claim deductions.

Carlos is a Non-Resident Outside the EU/EEA (e.g., Canada)

- Form: Model 210

- Taxable Base: Full gross income of €25,000 (no expenses can be deducted)

- Flat Tax Rate: 24%

- Tax Due: 24% × €25,000 = €6,000

Carlos is taxed on his gross income with no deductions, and files Model 210 annually in January.

As you can see, fiscal residency greatly impacts your final tax bill. In Carlos’s case, being a resident in Spain or another EU country results in similar tax savings. However, non-EU/EEA residents are at a significant disadvantage.

To ensure you maximize your allowable deductions and stay compliant with all deadlines and reporting obligations, Pambnb offers full support—from expense tracking to Model 210 and IRPF declarations. We handle the paperwork so you can focus on what matters: your investment.

How Pambnb Makes It Easy

At Pambnb, we provide year-round support to ensure you're not only maximizing your rental income, but doing it smartly and legally.

Our Accounting & Statement Services Include:

- 📌 Monthly and yearly income and expense tracking

- 📌 Generation of a complete Annual Statement (ready to send to your accountant or tax advisor)

- 📌 Guidance on IGIC obligations (Canary Islands VAT)

- 📌 Partner tax advisors who can file Modelo 210 on your behalf

- 📌 Personalized advice on what you can deduct—and how much

With Pambnb, you don’t have to worry about receipts, spreadsheets, or chasing your accountant at the last minute. We make sure your rental is a business that works for you.

Ready to Make the Most of Your Property?

Whether you're new to vacation rentals or have been managing your home for years, Pambnb can help you:

- Save time and money,

- Stay compliant with Spanish regulations,

- And enjoy peace of mind knowing professionals are taking care of every detail.

👉 Learn more about our full-service vacation rental management: www.pambnb.com

👉 Or get in touch for a free consultation and start optimizing your rental income today.

Smart property ownership isn’tjust about hosting—it’s about managing finances correctly. By understanding what expenses you can deduct and how to calculate them accurately, you’ll increase your bottom line, reduce stress, and future-proof your investment.

Let Pambnb be your trusted partner in short-term rental success—so you can focus on what matters most.